The Plasma Industry

Introduction to the Plasma Industry

Menu

Introduction

History of Plasma Fractionation

Clinical Use of Plasma Products

Worldwide Market Drivers

Plasma Procurement and Safety

A Look to the Future

The contents of this document represent our analysis of information generally available to the public or released by the companies mentioned. It does not contain information provided in confidence by our clients. Since much of the information in the study is based on a variety of sources (which we deem reliable) including subjective estimates and analyst opinion, the Marketing Research Bureau does not guarantee the accuracy of the contents and assumes no liability for inaccurate source materials.

Copyright © 2026 by the Marketing Research Bureau. All Rights Reserved. Published in the United States of America. No part of this publication may be reproduced, stored in a retrieval system, or transmitted, in any form or by any means, electronic, mechanical, photocopying, recording, or otherwise, without the prior written permission of the publisher.

Blood and Plasma: Two ways of saving life

Blood and Plasma: Two ways of saving life

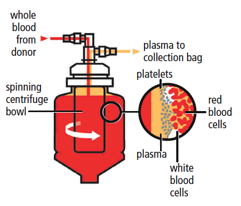

Whole blood consists of two main components; red blood cells which represent about 45% of the volume of a unit of blood, and plasma, which is the liquid portion of blood, making up the remaining 55%. Whole blood collected from a donor by an organization such as the Red Cross is routinely separated into these two components by centrifugation. These components are used for a variety of clinical conditions.

Another kind of donation is called “plasmapheresis” whereby the whole blood is drawn from the donor’s vein into a machine which separates plasma from the red cells by filtration or centrifugation. Once the red cells are separated from the plasma, they are returned to the donor using the same vein or a different one, depending on the machine used, and the plasma is used for a number of clinical or industrial purposes. The plasmapheresis procedure allows plasma to be collected more frequently from an individual than whole blood because the human body regenerates plasma within a few days while red blood cells require a few weeks. In the United States, a donor can donate plasma up to twice a week while for whole blood it is just once every three months. In most other countries the plasma donation frequency is once every week or two.

Red cells and whole blood are used to treat traumatic or surgical blood loss, as well as anemia. Plasma is used to correct deficiencies of certain coagulation factors, as well as trauma, shock and many other medical conditions. Plasma serves also as the raw material to manufacture a number of “plasma-derived” drugs through an industrial process called “fractionation” which isolates each “fraction” of the plasma by means of various chemical and physical methods and turns them into life-saving drugs: coagulation factor concentrates, immunoglobulins, albumin and others.

History of Plasma Fractionation

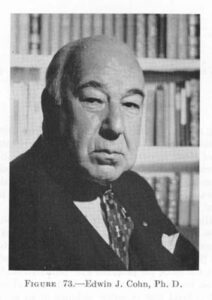

The history of plasma fractionation began with the need to develop blood serum products to help soldiers suffering from shock and burns in the Second World War. Dr. Edwin Cohn, of Harvard University, was a key figure in the development of a process to separate proteins from human plasma. Today, the “Cohn fractionation process,” remains the basis of many plasma fractionation facilities’ manufacturing process around the world.

The history of plasma fractionation began with the need to develop blood serum products to help soldiers suffering from shock and burns in the Second World War. Dr. Edwin Cohn, of Harvard University, was a key figure in the development of a process to separate proteins from human plasma. Today, the “Cohn fractionation process,” remains the basis of many plasma fractionation facilities’ manufacturing process around the world.

Originally, the aim of plasma fractionation was to separate albumin from plasma to treat injured soldiers. Albumin represents 55-60% of the total protein volume of plasma, and is easier to separate from plasma than any other proteins. Over time, a number of additional proteins were separated from plasma and used clinically. Each of these proteins can be used to treat one or several medical conditions, many of which are orphan diseases – meaning the number of patients affected is comparatively small. Many of the diseases treated with proteins derived from plasma are serious, life-threatening conditions.

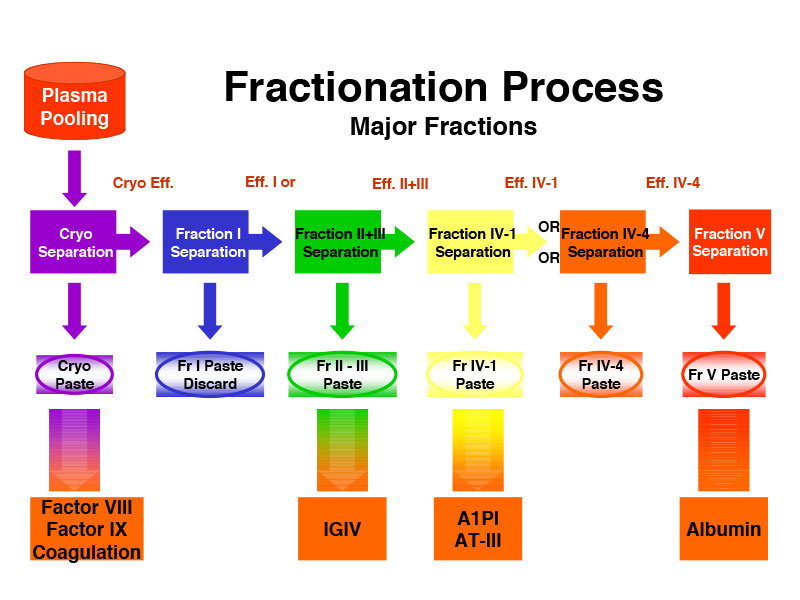

The Cohn fractionation process originally developed in the 1940’s involved modifying the pH, the ethanol concentration and the temperature of the plasma to separate its proteins through precipitation into five “fractions” (I-V).

Before starting the fractionation process, the “cryoprecipitate” which contains coagulation factors VIII and IX, is removed. These coagulation factors are missing in hemophilia patients (factor VIII in hemophilia A, and factor IX in hemophilia B), putting them at risk of uncontrolled bleeding. In the 1960’s, methods were developed to purify factor VIII and later factor IX from fraction I of plasma, enabling hemophilia patients to use these purified proteins in concentrated form for treatment. Before factors VIII and IX concentrates were developed, hemophilia patients had to infuse fresh plasma, or cryoprecipitate in non-concentrated form, or even whole blood to stop bleeding. These modes of hemophilia treatments are still a reality for a few in a some low-income countries.

In the 1950’s intramuscular immunoglobulin (IMIG) was developed from fractions II and III and introduced as replacement therapy for patients with congenital antibody deficiencies. Since the intramuscular injections were painful, only small volumes could be administered, which prevented adequate dosing. In the 1980’s, the purification methods had sufficiently improved to enable the production of “intact” molecules (similar to those found in human plasma) with full biological efficacy. As they were better tolerated, these preparations could be administered intravenously, significantly enhancing their clinical efficacy. This makes it possible for intravenous immunoglobulin (IVIG) to be prescribed for a growing number of medical indications. In the late 1990’s, a new form of administration of immunoglobulin using the subcutaneous route became available, offering patients an alternative to the intravenous route.

In the late 1980’s, alpha-1 proteinase inhibitor (A1PI) was purified from fraction IV and commercialized for the treatment of a hereditary form of emphysema caused by low alpha-1 protein levels. The fraction IV of plasma also comprises antithrombin III, another protein introduced in the market in the 1980’s while fraction V contains almost exclusively albumin.

For more information on the steps involved in plasma fractionation, see our recently released report, detailing costs, trends and IG yields of different brands of IVIG and SCIG.

The Cohn Fractionation Process

A Modern Plasma Fractionation Facility (Grifols)

Over the years, the Cohn fractionation process was improved and complemented by new technologies. Using chromatography processes to purify specific proteins, the industry has significantly increased production yields, in particular IVIG. More recently, some companies, such as Evolve Biologics are using ligands to extract and purify plasma proteins achieving higher yields but they have not yet introduced any product on the market.

Companies continuously endeavor to maximize their production yields so as to get the most from human plasma and generate more revenues from a liter of plasma.

A Modern Plasma Fractionation Facility (Grifols)

Today’s plasma fractionation plants are large and complex, capable of fractionating millions of liters of plasma into a wide variety of therapeutic products.

Clinical Uses of Plasma Products

Over fifty therapeutic plasma proteins are commercially available, and new ones are being evaluated for therapeutic use. Furthermore, the industry seeks new clinical uses for existing proteins. Many of the diseases treated with plasma proteins are rare – affecting relatively few patients. Consequently, many of these proteins are classified as orphan drugs. There are four main categories of plasma-based products:

- Immune globulins (IgG) are produced by B-cells in the body to identify and help destroy foreign molecules, including bacteria and viruses. They are the main function of the body’s humoral immune system. Replacement therapy with immune globulins has been used extensively since their commercial introduction in the 1950’s. Two categories of immunoglobulin preparations exist today:

- Polyvalent intravenous and subcutaneous immunoglobulins (IVIG/SCIG), or IgG are the most common preparations, consisting in millions of antibodies (immunoglobulins) concentrated into a vial capable of fighting a multitude of bacterial and viral infections, as well as diseases in other areas, including autoimmune disorders, hematology, infectious diseases, immuno-compromised cancer patients, some neurological conditions, etc. Polyvalent IgG was first prescribed as an antibody replacement therapy for congenital immuno-deficiencies through the intramuscular route, and subsequently intravenously and subcutaneously. Later on, IgG was also found to be also efficacious as a result of its immuno-modulatory effects on the human body. In this mode of action, it is prescribed for treating various neurological and autoimmune conditions. Well over 200 diseases have been identified for IgG treatment, many of them affecting only a small number of patients.The indications approved by the FDA and other regulatory agencies include: Primary Immunodeficiencies (PID), Chronic Inflammatory Demyelinating Polyneuropathy (CIDP), Idiopathic Thrombocytopenic Purpura (ITP), Multifocal Motor Neuropathy (MMN), Kawasaki Disease, Chronic Lymphocytic Leukemia (CLL) and Bone Marrow Transplant (BMT).

- Hyperimmune immunoglobulins are preparations in which the level of some specific antibodies has been enriched to target a particular antigen, as opposed to the naturally diverse set of antibodies present in IgG. Specific hyperimmune preparations are manufactured for such conditions as Anti-D (anti-RhoD), Cytomegalovirus (CMV), Hepatitis A and B, Rabies, Tetanus, Varicella, etc. Some rare products target anthrax or other viruses for bio-defense purposes. Attempts to develop an anti-HIV immune globulin failed due to manufacturing difficulties, and are no longer pursued because of the efficacy of the currently available anti-HIV immunotherapies.

- Coagulation factors or clotting factors, such as factor VIII and IX are proteins involved in the human body’s “coagulation cascade” – the whole process of controlling blood clotting. Congenital hemophilia is the result of a missing or dysfunctional factor protein in the coagulation cascade. A person with hemophilia is often unable to control a bleeding situation and requires “replacement therapy” for the missing clotting protein.

- Hemophilia A: Factor VIII deficiency causes hemophilia A, and can be mild, moderate or severe. Many moderate and severe patients need factor VIII replacement therapy either on a regular basis (prophylaxis) or in the event of a bleeding episode (on-demand)

- Hemophilia B: Factor IX deficiency causes hemophilia B, and like hemophilia A, it may be mild, moderate or severe, although it is not as prevalent as hemophilia A worldwide: the ratio is roughly 5:1 hemophilia A to hemophilia B. Hemophilia B requires factor IX replacement therapy. Hemophilia A and B affect males at much higher rates than females because it is an X-linked chromosomal disease.

- Von Willebrand Disease (vWD): Von Willebrand Disease is caused by the lack or dysfunction of the von Willebrand Factor (vWF), which binds with factor VIII to promote blood clotting. This disease is more prevalent than hemophilia, but a greater percentage of patients are mild and need little treatment. Severe patients often require the use of a product containing vWF, which generally also contains factor VIII. vWD equally affects males and females.

- Other Factor Deficiencies: There are several other factor deficiencies, some of which are acquired during surgery or blood loss situations, while others are congenital. These include deficiencies of factors II, V, VII, X, XI, XIII and fibrinogen (FI).

- Albumin has been used since the 1940’s as a volume replacement therapy for blood or fluid loss in surgery or trauma situations. It is also used in cirrhotic patients, those with liver diseases, sepsis, septic shock, therapeutic plasma exchange, burn therapy and renal dialysis, among others. In some of these conditions, albumin competes with non-protein based volume replacement solutions such as starches, Ringer’s Lactate or saline.

- Alpha-1 antitrypsin (AAT) or Alpha-1 Proteinase Inhibitor (A1PI) is used as a replacement therapy for A1PI deficiency, which is a rare genetic disorder characterized by reduced serum levels of the A1PI enzyme. It causes a variety of conditions including emphysema, chronic obstructive pulmonary disease (COPD), bronchiectasis, chronic bronchitis, cirrhosis, neonatal hepatitis and jaundice. Alpha-1 antitrypsin deficiency is found mainly among people of northern European descent, and it is less common in other populations, and practically non-existent in Asia.

- Antithrombin III (AT-III) is used as a replacement therapy for AT-III deficiency, which results in the inability to adequately control the clotting process, leading to excessive clotting and risk of thrombosis. The congenital deficiency is rare, but the acquired form can develop from liver dysfunction, sepsis, etc. and major surgery. AT-III can be used before, during or after surgery as an anticoagulant for patients suffering from low AT-III protein levels.

- C1 Esterase Inhibitor (C1-INH) is used as a replacement therapy for Hereditary Angioedema (HAE), which results in the swelling of the face, neck, extremities and upper airways. If left unchecked, this rare disease causes swelling of the larynx, which can lead to suffocation. C1-INH therapy replaces the missing protein in this congenital disease.

- Albumin

Plasma Economics: How Demand for Plasma Proteins Affects Plasma Fractionation Volumes

Source: Grifols

Unlike the traditional pharmaceutical industry, the plasma industry uses living cells – human blood plasma – as its raw material to manufacture life-saving drugs. The production of these drugs depends on a supply of raw material which is not in infinite supply, and which is generally significantly more expensive and complicated to obtain than non-living molecules and even biologics grown in biotechnology facilities. It is roughly estimated that the cost of the raw material exceeds 50% of the finished product’s cost, compared with less than 5% in the traditional pharmaceutical industry. The supply of plasma for fractionation, due to its human origin needs to be carefully planned and managed. Therefore, there is a close link between plasma fractionation volumes, or plant throughput, and the demand for the various therapeutic proteins. Plasma economics illustrate this relationship.

Even though many proteins can be separated from plasma and commercialized, some of them are more in demand than others. Those generating the highest demand determine the volume of plasma needed for fractionation. By maximizing the volume of plasma fractionated to make each product in adequate quantity, a company can maximize its revenues and profitability. Dubbed “plasma economics”, it leads to the concept of “first liter” and “last liter” (or “marginal liter”) of the plasma fractionated by a company.

a) The “first liter” of plasma describes a liter of fractionated plasma from which all the plasma proteins are sold by the company. Since it includes all the company’s commercial products, this first liter of plasma fractionated generates the maximum amount of revenues from each liter fractionated.

b) As more plasma is fractionated, the quantities of proteins (or products) which have low demand, due to smaller patient populations such as factor IX, antithrombin III, etc., are no longer needed so these products are not purified from the plasma and the proteins are ultimately discarded.

c) Since there is still enough demand for the other proteins, such as factor VIII, due to its larger patient populations and demand, the company still purifies it from the plasma it fractionates after the initial low demand proteins are already discarded. Once the factor VIII demand is met, it is no longer purified from the next liter of plasma and discarded.

d) As more plasma is fractionated, one-by-one, each protein product is manufactured in sufficient quantities to meet its respective demand and it is removed from the list of purified products from the next liter of plasma. Eventually, only one product remains to justify fractionation, which has been IgG for over 20 years. It is the product with the highest demand, requiring the highest volume of fractionated plasma.

As an example, say a fractionation company fractionated 1.0 million liters of plasma every year. The first liter production might include hyperimmune products, rare coagulation products and specialty fractions like AAT, AT-III or fibrinogen. These are high value but low demand products, so not much plasma is needed to produce a entire year’s supply of them. By the time the company has fractionated 0.4 million liters, there is enough production of these low demand products to satisfy the company’s annual demand and so they don’t need to make more until the next year. However, there is still a need for IgG, albumin and factor VIII, so all three of these proteins continue to be purified. After more volume of fractionation, say 0.7 million liters, there is no more demand for factor VIII, so it drops from the purification list and just IgG and albumin are purified. If just IgG and albumin are purified all the way to the full 1.0 million liter annual throughput, they represent the “last liter” products because they are purified from each liter that was fractionated, unlike the low demand proteins.

In practice, the “last liter” is determined by the demand for IgG by company because it is the product with the most demand relative to production volumes. Albumin is often still in demand at this fractionation level, leading the companies to sell two “last liter” products; IgG and albumin, though the revenue from albumin is much less than the revenue from IgG. Many companies opt for the “two last liters” strategy because the revenues from only one product (albumin or IgG) do not suffice to cover their cost of collecting and fractionating plasma or lead to unacceptably low profit levels. This is starting to change and some companies are exploring the economics of a one product last liter (IgG).

IgG has been the driver of plasma fractionation volumes for over twenty years. Prior to that, factor VIII was the driving protein for fractionation, but it gradually ended when recombinant factor VIII products were introduced in the early 1990’s and cannibalized plasma-derived factor VIII. The first “last liter” product was albumin, which was the first product fractionated from plasma going all the way back to World War II. At present, IgG and albumin usually sold from every liter of plasma fractionated, and factor VIII is still sold from many of the liters fractionated. Today, IgG accounts for around 50% of the global plasma proteins market (approximately $12 billion) although this percentage varies significantly by region. Albumin and plasma-derived factor VIII (pdFVIII) each have a smaller share of the market (10-15% each) again with wide regional variations. Please Contact Us if you would like the latest figures on plasma protein sales by product, company or country.

Plasma Procurement and Safety

Diagram of automated plasma collection procedure

Source: CSL Behring

Plasma Collection:

To obtain enough raw materials to produce plasma products, tens of millions of liters of plasma are needed annually. Some of the plasma is obtained by separating plasma from red blood cells after whole blood donation, for example at a Red Cross Blood Drive. This plasma is called “recovered plasma” because the goal of the blood collection organization it to obtain red cells and platelets, and plasma is a by-product. Another type of plasma for fractionation, called “source plasma,” is generated by dedicated plasma collection centers, which collect plasma from donors through plasmapheresis machines (these machines extract whole blood from the donor, keep the plasma and return the red cells to him/her). In the United States and a few other countries, plasma donors receive cash compensation for their time and efforts as they may donate frequently, while whole blood donors are encouraged to donate by means of a token non-monetary incentive.

Plasma donation using a plasmapheresis machine

Source: Fenwal

It is essential for each company to have access to a sufficient quantity of plasma to meet its production objectives. To this end, the large, multinational plasma companies (the fractionators) own almost all the plasma collection centers in the U.S., where they collect most of the plasma they need. Source plasma is also collected in significant quantities in China, Germany, Austria, Czech Republic and Hungary. Together, the largest three companies (CSL Plasma, Grifols and BioLife (Takeda) collect over 75% of the total U.S. source plasma for fractionation.

In recent years, the number of plasma centers has increased significantly in the United States, from less than 500 in 2015 to over 1,200 in 2025, reflecting that the needs for therapeutic plasma proteins is anticipated to continue to grow in the coming years.

A similar trend has been observed in Europe although the regulations in place in the region do not allow donors to donate as frequently or be paid as much as a donor in the United States, limiting the growth of plasma collections for fractionation in Europe. Please Contact Us for the latest figures on plasma collection by company or country.

Plasma Safety and Viral Inactivation:

Following cases of virus transmission from blood and blood products in the 1980’s, in particular HIV, the plasma industry has implemented strict controls to ensure that only plasma from non-infected donors is used to make plasma products. A variety of measures have been introduced to increase the safety of plasma, some of them introduced by the Plasma Proteins Therapeutics Association (PPTA), the commercial plasma industry group. A set of measures promulgated by PPTA is the “Quality Plasma Program” (QPP) which includes quarantine of donors’ first plasma donation, plasma inventory holds, donor selection and donation screening by nucleic acid testing (NAT) for HIV, Hepatitis B and C.

In addition to selecting donors and testing plasma for specific viruses, the plasma industry has developed several viral inactivation techniques to remove known and unknown viruses and bacteria in the fractionation and purification processes. These techniques include solvent/detergent washes, low pH, heat, nanofiltration, and chromatography. These techniques reduce the risk of any virus transmission from a plasma product by several orders of magnitude. Companies and academic researchers continue to search for new methods of viral inactivation to further improve the safety of plasma-derived products.

Plasma Donation using a plasmapheresis machine

Source: Fenwal

Product Pricing and Cost Structure

The plasma industry’s cost structure differs from the traditional pharmaceutical or biotechnology industries. The cost of plasma – the plasma industry’s raw material – is generally higher than the cost of the raw materials used in the traditional pharmaceutical or biotechnology industries. Plasma is expensive because collecting plasma is a complicated and delicate operation, involving a large workforce due to the need to collect plasma from hundreds of thousands of people. Components of this cost include plasmapheresis equipment and highly qualified staff, donors have to donate plasma frequently and many donors are needed by the companies, complex logistics, strict regulations, and donor compensation. As mentioned, it is generally estimated that plasma, the raw material, represents over 50% of the total cost to produce plasma-based therapeutic proteins. Please Contact Us for the latest figures on plasma fractionation costs or yields for IgG.

For a patient, the annual cost of therapy using a plasma-based product may exceed $200,000, representing an obstacle to their acceptance in many countries although significant progress has been observed in recent years. As healthcare budgets continue to be under increasing pressure, advocacy and awareness are used to ensure that patients in need of these therapies have access to them.

A look to the Future

The plasma industry has experienced strong growth in the 21st century, going from just over $5 billion in global sales in 2000 to over $35 billion in 2024 (excluding recombinant products). In 2024, we calculate that over 18.5 million people across the globe received a plasma derived protein product during the year. This included 1.21 million people in the United States and 8.8 million people in China, the latter mostly due to high usage of anti-Tetanus and anti-rabies hyperimmunes. Overall, hyperimmune products globally were responsible for over 70% of the patients who used plasma derived products, or 14.5 million people in 2024. Globally, over 800,000 people received IgG (IVIG or SCIG), with over 25% of that total, or over 200,000 people receiving IgG in the United States in 2024. Given that over 85% of plasma used for fractionation comes from source plasma, over 16 million of the plasma derived product patients rely on plasma collected by plasmapheresis.

The significant multi-decade growth has mainly been caused by new patients diagnosed and starting therapy with IgG, albumin and other plasma proteins. Even though only 1 new plasma protein (plasminogen) has been introduced in the past ten years, the plasma industry is expected to continue expanding due to higher usage of core plasma proteins such as IgG as well as geographic expansion. Some of the current research efforts with plasma-based products are described below.

New Products Fractionated from Plasma

After a decades-long hiatus, the industry is on the cusp of introducing new plasma proteins. Plasminogen has finally recently been approved and launched by Kedrion, CSL Behring is exploring reconstituted HDL from plasma, and companies seeking to commercialize novel proteins are exploring new business models. More than 2,000 proteins exist in plasma, with only 15-20 commercialized, leaving the vast majority of potential proteins unexploited for commercialization. It is unlikely that a new protein will supplant IgG as the plasma industry driver, but additional proteins will contribute to the industry’s economic viability and benefit new patients with safe and efficacious plasma therapies, unless superior biotechnology-derived drugs and gene therapy options can be developed. Until such time, donor plasma will continue to be needed in growing quantities.

New Indications for Plasma-based Products

Other plasma-based products are under investigation for additional diseases or indications, including:

- IVIG & SCIG in various diseases (Myasthenia Gravis, Neuropathic Pain, Secondary Immunodeficiencies, Dermatomyositis, etc.),

- Albumin in Cirrhosis, liver disease, Alzheimer’s Disease, Malaria and Sepsis,

- Alpha-1 antitrypsin in lung Graft-vs-Host Disease (GVHD), Lung injuries, and

- Fibrinogen in aortic aneurysm surgery with acquired fibrinogen deficiency,

- C1 INH for antibody-mediated rejection in organ transplantation

- ApoA-1 for Acute Coronary Syndrome

New Formulations

In addition to new proteins and indications, the plasma industry continues to investigate new formulations for plasma-based products. For example, the original intramuscular formulation of immune globulins was not able to provide the volume necessary for optimal dosing in disease treatment. The development of intravenous (IVIG) formulations at 5%, then 10% concentration allowed for larger quantities of immune globulin to be infused, expanding the scope of diseases which could be successfully be treated with the product. More recently, subcutaneous (SCIG) preparations have gained market acceptance. First, for low dose applications, and then to additional diseases with higher dosage such as CIDP. A subcutaneous version C1-INH was approved in 2017, after decades of an intravenous version on the market. Smaller reconstitution vial sizes have made it possible to administer coagulation factors to small infants, avoiding the need for ports, and efforts are made to find ways to administer these products through different routes, such as subcutaneously. New formulations are in development for other plasma-derived products, such as inhaled AAT, which may increase their usefulness and/or decrease dosing and thus costs.

Competition from new Technologies

In the past four years a number of new recombinant and non-factor products have been introduced in the area of hemophilia therapy, representing increased competition to plasma-derived coagulation factors.

In the early 1990’s, the first recombinant factor VIII was introduced. Since then, many recombinant proteins have been developed, including recombinant factor VIIa, factor IX, factor XIII, von Willebrand factor, albumin, antithrombin-III, C1 esterase inhibitor (C1-INH) and thrombin. Additional recombinant proteins are under development including recombinant fibrinogen, alpha-1 antitrypsin, and others.

In 2014, the first extended half-life recombinant factor VIII and IX products were approved in the U.S. With an improved bio-availability over their plasma-derived competitors, these products provided higher trough levels in hemophilia patients, allowing them to infuse the product less frequently, which enhanced the patients comfort, reducing their dependency on frequent factor infusions. The availability of these new recombinant products increased the number of products available for hemophilia A and B treatment, leading to price erosion of the less advanced products, including the plasma-derived, particularly outside the United States.

In late 2017, Roche’s Hemlibra, a bi-specific monoclonal antibody, was approved by the FDA and the EMA (February 2018) for the treatment of hemophilia A patients with inhibitors antibodies to Factor VIII. In October 2018, Hemlibra was approved in the U.S. for the treatment of all hemophilia A patients. As it only requires one subcutaneous drug infusion weekly bi-weekly, or monthly, depending on the patients severity. Since then, it has gained rapid acceptance, affecting the entire factor VIII sales levels in the U.S. In addition, gene therapy for hemophilia A and B was approved in 2022, representing a “cure” for the disease after just one infusion. The average durability of gene therapy treatment is still unknown, but indications are that it will last at least a few years and possibly more than a decade. Gene therapy will eventually cause a disruption in the marketplace for hemophilia treatment, though its uptake will be initially be slow and be restricted to adults severe patients at first.

As coagulation factors made from plasma have now been relegated to a secondary position in the hemophilia care market, immunoglobulin has become ever more important to sustain the economic viability of the plasma industry, along with albumin. To this day, the market preeminence of intravenous and subcutaneous immune globulin (IgG) in treating a number of autoimmune diseases was unsurpassed. However, several biotechnology companies (Argenx, UCB, Momenta, etc.) have recently developed new monoclonal antibodies (anti-FcRn agents such as Vyvgart, Vyvgart Hytrulo and Rystiggo) or recombinant products (recombinant trivalent IgG1 Fc multimers) that mimic the immune modulatory mode of action of IgG in the treatment of some diseases, such as ITP, Pemphigus Vulgaris, MMN, CIDP and Myasthenia Gravis. Some of these products entered the market recently and others may enter soon, and could begin to impact the IgG market in the next few years if they prove to be safe, efficacious, and price competitive. The ultimate effect of these novel agents on IgG is fiercely debated and is the subject of several recent reports by the Marketing Research Bureau.

For immunoglobulins, the first new competition in the form of FcRns has been commercialized since late 2021. Competition from Complement System inhibitors might begin in CIDP in 2027. How much will this affect the demand for immunoglobulins in diseases such as Myasthenia Gravis, ITP and CIDP? This is the subject of our Immunoglobulin Forecast reports, based extensive information gathered from experts in all parts of industry.

Recombinant therapeutic albumin was only commercialized in Japan, and failed to gain significant market share because its prohibitive price and absence of clinical superiority compared to plasma-derived albumin. As a result, it was eventually withdrawn from the market and has not been re-introduced since. However, more recent efforts at recombinant albumin, including by using recombinant technology to produce human albumin in rice plants achieved approval in China in mid-2025. Recombinant albumin made in yeast or other liquid mediums in large bioreactors is also starting to be approved in some countries, with several in China and India under development. These will result in new competition with plasma derived albumin. Non-plasma-based, non-biotech plasma volume replacement solutions, such as starches have been on the market for a number of decades at much lower prices than human albumin. While they represent inexpensive alternatives for budget-constrained customers, their efficacy and particularly their safety do not match human albumin in many clinical indications. In addition, recombinant and bovine albumin is used in non-therapeutic applications, as is plasma derived human albumin. Contact us if you are interested in learning more about our forecast reports for human albumin for therapeutic use and separately for non-therapeutic use.

Monoclonal antibodies (mAB) and oral small molecules to prevent Hereditary Angioedema (HAE) now compete strongly with plasma derived C1-INH products in this disease, with more competition expected in the near future. Extended half-life (EHL) AAT versions, novel mAB and small molecules are under development to treatment of Alpha-1 Antitrypsin Deficiency. As the pharmaceutical industry continues to innovate and evolve, the prospects and positioning of plasma derived products will change with it, and it is important to know the latest information to make informed decisions.

For more information…

Since 1974, the Marketing Research Bureau has been supplying market data and intelligence to the plasma industry. Its syndicated reports cover over 100 countries and provide quantitative and qualitative data. Other studies forecast the demand for the main plasma proteins in the future given the competitive threats and cover other topics. For more information, please contact us or give us a call.